direct vs indirect cash flow gaap

Also known as the income statement method the direct method cash flow statement tracks the flow of cash that comes in and goes out of a company in a specific period. The indirect method by contrast means reports are often easier to prepare as businesses typically already keep records on an accrual basis which provides a better overview of the ebb and flow of activity.

The Indirect Cash Flow Statement Method

However of the two the direct method is generally encouraged.

. The direct method is particularly useful for smaller business that dont have a lot of fixed assets as the direct method uses only actual cash income and expenses to calculate total income and losses. GAAP also calls the indirect method the reconciliation method. Assume that a company sold land for 100000 and paid.

Statement of position Exhibit 3. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. The indirect method is a method for creating a statement of cash flows a company may use during any given reporting period.

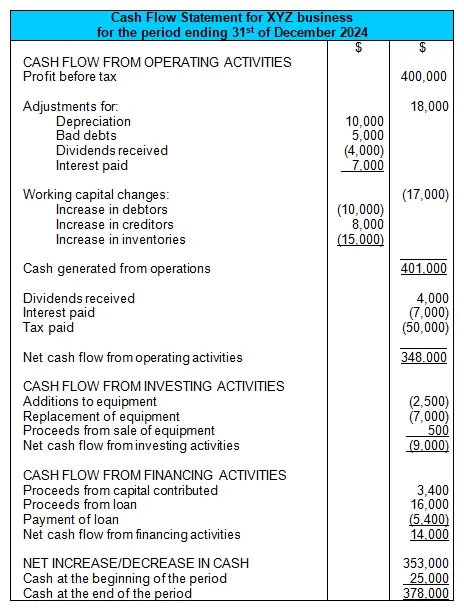

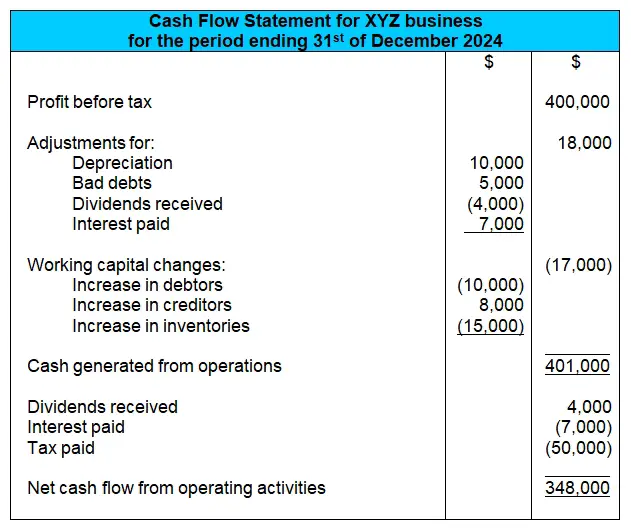

The direct method the income statement is reformulated on a cash basis rather than an accrual basis from the top of the statement the income part to the bottom the expense part. The cash flow statement CFS provides information about a companys cash receipts and payments from operating activities investing activities and financing activities. Under the direct method net income is not reconciled to net cash flow from operating.

Its also more widely used so should be more familiar to investors and its better-suited to large firms with high transaction. Direct expenses include things like payroll costs and rent while indirect expenses could include equipment-related costs such as insurance or depreciation as well as sales which Direct vs Indirect Cash Flow are still in accounts receivable. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions.

A business cash flow statement shows the companys profits and losses within a given time frame. To perform this calculation begin with net income add back non-cash. The following are the common types of adjustments that are made to.

The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. Indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. To perform this calculation begin with net income add back non-cash.

Accounting standards allow two presentation formats. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

Both ways end up at the same answer but in a different way. Bank overdrafts are classified as part of cash and cash equivalents Either the direct or indirect method may be used for reporting cash flow from operating activities. The direct method is one of two different accounting treatments used to prepare the cash flow statement.

Direct cash flow method lists all of the major operating cash receipts and payments for the accounting year by source. It informs a company about their financial status allowing. This method also identifies changes in cash payments and receipts as a result of a companys operating activities.

Currently more than 120 countries require or permit the use of International Financial Reporting Standards IFRS with a significant number of countries requiring IFRS or some form of IFRS by public entities as defined by those specific countries. 108 In addition unlike. Up to 5 cash back 5412 Comparison with the Reconciliation Method under US.

A direct method which shows specific operating cash inflows and outflows and b indirect method which starts with. Sample Direct Reporting. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

There are no presentation differences between the methods in. An example of the tax treatment is provided below. It requires the use of the actual cash inflows and outflows of the organization.

Statement of cash flows Keywords. Income tax reported as operating activity except when tax is an expense related to investing or financing activity. And statement of cash flows Exhibit 4 for a hypothetical NFP entity using the indirect methodThe NFP organizations governing board now desires a cash flow statement that better.

The indirect method uses accrual accounting information. Chances are if you are in business you use both direct and indirect cash flow to report your net. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash.

IAS 7 and Section 230-10-45 FASB Statement No. Statement of cash flows Subject. The first four Exhibits show the trial balance used to develop the financial statements statement of activities Exhibit 2.

The indirect method on the other hand. Interest received must be classified as an operating activity. 106 Both encourage the use of the direct method.

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. With respect to the treatment of activities in cash flow statements there are some differences in IFRS and US GAAP. Indirect method is the most widely used method for the calculation of net cash flow from operating activities.

The indirect method works from net income so the bottom of the income statement and adjusts it to. The actual inflows received and the outflows paid for and not accrued are added and subtracted in the cash flow statement using the direct method.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Indirect Cash Flow Statement Method

Vat Transactions Entries And Examples Accounting Taxation Entry Example Accounting

Direct Vs Indirect The Best Cash Flow Method Vena

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Method Statement Of Cash Flows Youtube

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Statement Of Cash Flows Revisited Chapter 21

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com Managerial Accounting Accounting Education Accounting

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Accounts That Can Be Adjusted Accrued Revenues Accrued Expenses Deferred Expenses And Deferred Re Learn Accounting Accounting Principles Accounting Student

How To Convert Cash Basis To Accrual Basis Business Tax Deductions Cost Accounting Cost Of Goods Sold

The Accounting Equation Accounting Finance Humanresources Accounting Student Accounting Basics Business Management